BTC Price Prediction: Technical Support Meets Institutional Momentum

#BTC

- Technical Support Levels: Bitcoin trading near Bollinger Band lower boundary suggests potential rebound opportunity

- Institutional Momentum: Growing corporate adoption and derivatives market development support long-term valuation

- Risk Management Essential: Macroeconomic uncertainties require careful position sizing and portfolio allocation

BTC Price Prediction

BTC Technical Analysis: Key Indicators Signal Potential Rebound

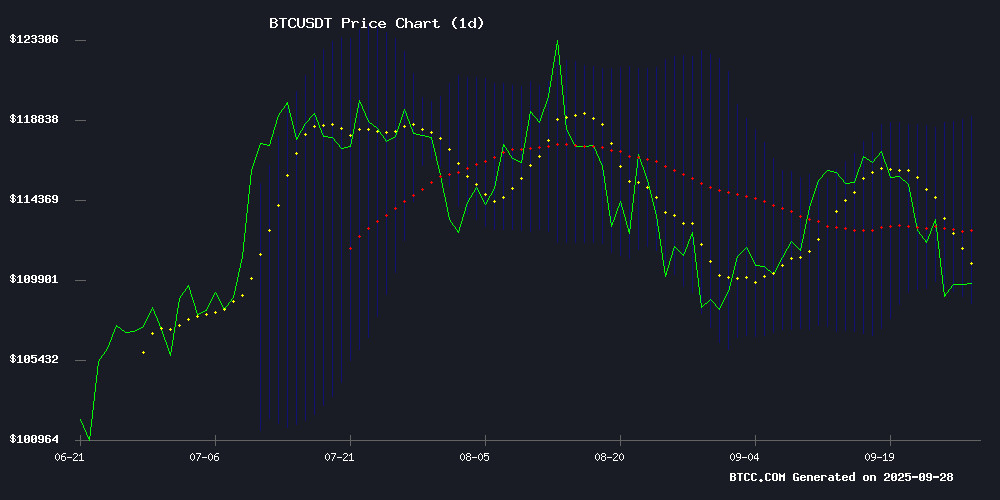

According to BTCC financial analyst Ava, Bitcoin's current price of $109,356 sits below the 20-day moving average of $113,800, indicating short-term bearish pressure. However, the MACD shows bullish momentum with a positive histogram of 1,829.32, suggesting potential upward movement. The Bollinger Bands position the current price near the lower band at $108,512, which often serves as a support level. 'The technical setup suggests Bitcoin is testing crucial support levels,' Ava notes. 'A bounce from current levels could target the middle Bollinger Band around $113,800.'

Mixed Market Sentiment: Institutional Growth vs Macroeconomic Concerns

BTCC financial analyst Ava observes conflicting signals from recent news flow. 'While institutional interest and derivatives growth point toward Bitcoin's $10 trillion market cap potential, macroeconomic headwinds and regulatory warnings create near-term uncertainty,' Ava states. The positive developments include Brazil's corporate adoption reaching 15% on Mercado bitcoin and the U.S. Genius Act potentially integrating Bitcoin into stablecoin networks. However, warnings about dotcom-like crashes and downward pressure from macroeconomic factors temper optimism. 'The news sentiment aligns with our technical view that Bitcoin faces resistance but maintains long-term growth prospects,' Ava concludes.

Factors Influencing BTC's Price

Bitcoin’s $10 Trillion Market Cap Potential Hinges on Derivatives Growth

Bitcoin's march toward a $10 trillion market capitalization may find its catalyst in derivatives products, according to analyst James Van Straten. Options contracts and futures are reshaping market dynamics, attracting institutional capital while potentially tempering the cryptocurrency's notorious volatility.

The Chicago Mercantile Exchange's record Bitcoin futures open interest signals a structural shift. As the world's largest derivatives marketplace deepens its crypto involvement, liquidity pools expand and institutional participation grows. "CME options open interest has never been higher," notes Van Straten, attributing part of this activity to sophisticated volatility-selling strategies like covered calls.

This derivatives-driven maturation presents a paradox. While stabilizing mechanisms could dampen Bitcoin's explosive rallies, they may also pave the way for unprecedented valuation thresholds. The market now grapples with whether financial engineering or raw speculative psychology will ultimately dictate Bitcoin's trajectory.

Bitcoin Soars: Institutional Interest Sparks $200K Price Speculation

Galaxy Digital CEO Mike Novogratz predicts Bitcoin could surge to $200,000, citing unprecedented institutional demand and the emergence of tokenized finance. The cryptocurrency's current cycle diverges from historical patterns as Wall Street firms and banks explore blockchain-based asset solutions.

Novogratz revealed Galaxy executed a $9 billion Bitcoin sale for a client, suggesting even greater price potential without such large-scale disposals. While cautioning against cyclical complacency, he acknowledged structural shifts through financial institutions developing custody solutions and tokenization frameworks.

Bitcoin Derivatives Poised to Propel Market Cap Toward $10 Trillion

Bitcoin derivatives are emerging as a transformative force in cryptocurrency markets, with analysts projecting they could drive BTC's total valuation to $10 trillion. The surge in institutional participation through instruments like CME-listed futures and options underscores this shift.

Chicago Mercantile Exchange data reveals record-breaking open interest in Bitcoin options, signaling deepening market sophistication. Financial derivatives such as covered calls are simultaneously dampening volatility and creating more stable trading conditions.

"CME options open interest has never been higher," observes market analyst James Van Straten, who sees derivatives as the catalyst for Bitcoin's next evolutionary phase. The growing institutional footprint through these regulated products is reshaping market dynamics.

Crypto Treasuries Warning: Dotcom-Like Crash Possible as Hype Outpaces Fundamentals

Ray Youssef, founder of peer-to-peer platform NoOnes, draws stark parallels between today's crypto treasury boom and the dotcom bubble's collapse. Corporate Bitcoin accumulation mirrors the reckless speculation of 1999-2000, when companies with weak fundamentals fueled a market that eventually crashed 80%.

The current cycle sees institutions loading up on BTC and blue-chip assets as balance sheet trophies - a strategy Youssef warns could backfire spectacularly. When overleveraged firms face liquidation, their forced sell-offs may trigger cascading market declines reminiscent of Nasdaq's 2001 reckoning.

Not all players will perish. Disciplined firms managing risk exposure could emerge as dominant buyers during the shakeout. The coming bifurcation between prudent operators and hype-chasing treasury holders may redefine crypto's institutional landscape.

NYDIG Urges Bitcoin Treasury Firms to Abandon 'Misleading' mNAV Metric Amid Landmark Merger

Strive Asset Management's acquisition of Semler Scientific marks the first-ever merger between two Digital Asset Treasuries (DATs), creating a combined entity holding over 10,900 BTC. The deal highlights growing institutional interest in bitcoin-backed corporate strategies, but also exposes flaws in current valuation methodologies.

NYDIG's research team has called for the elimination of the mNAV metric, calling it 'disingenuous' for failing to account for operational businesses and using questionable share-count assumptions. 'Convertible debt represents a real liability, not just potential equity dilution,' noted Greg Cipolaro, Global Head of Research at NYDIG.

The critique comes as bitcoin treasury strategies gain traction among public companies, with the merged ASST-SMLR entity demonstrating how NAV growth can attract investors seeking crypto exposure through traditional equity markets.

Corporate Crypto Adoption in Brazil Grows as Firms Hold 15% on Mercado Bitcoin

Corporate participation is quietly reshaping Brazil’s crypto landscape, with small and medium-sized enterprises now accounting for as much as 15% of all assets held on Mercado Bitcoin, the country’s largest digital asset exchange.

According to Daniel Cunha, head of corporate development at the firm, these companies are not treating Bitcoin and stablecoins as speculative plays. Instead, they are using them as conservative treasury tools, holding steady positions rather than chasing quick trades. “They barely touch more than 10% of their reserves at a time,” Cunha explained during the exchange’s DAC 2025 conference, underscoring that the strategy is about balance sheet protection, not day-to-day speculation.

The motivation is clear. With concerns mounting over inflation, currency devaluation, and geopolitical instability, businesses are turning to crypto as a shield for their reserves. Most of the focus has been on bitcoin and dollar-backed stablecoins such as USDT and USDC, reflecting a defensive, cash-management approach rather than experimental allocations to altcoins.

Brazil has long been a fertile ground for crypto adoption, consistently ranking among the top countries in global usage. Yet the corporate side of the market remains underdeveloped. Only a handful of publicly traded firms in the country have officially disclosed Bitcoin holdings, with retail-focused Méliuz being one example.

Bitcoin Dominance Rebounds as Analysts Warn of Potential Crash to $94K

Bitcoin's market dominance is staging a sharp recovery, signaling potential turbulence ahead for altcoins. Analysts now warn that BTC could face a 15% correction toward $94,334 if key support levels fail to hold. The $116,354 price point has emerged as a critical resistance level—a breach of which could determine whether Bitcoin stabilizes or extends its decline.

Market observers point to concerning signals from MVRV bands, suggesting weakening momentum. 'When Bitcoin loses its mean band support, history shows we typically see accelerated selling,' notes analyst Ali Martinez. The rebound in BTC dominance coincides with altcoins underperforming, suggesting capital may be rotating back to the market leader amid uncertainty.

While the current pullback remains contained within expected retracement parameters, traders are watching the $94,000 support zone as a potential make-or-break level. The market appears to be consolidating after recent volatility, with liquidity patterns favoring Bitcoin over speculative altcoin plays in the near term.

Brazilian SMEs Turn to Bitcoin for Financial Safeguarding

Small and medium-sized enterprises in Brazil are increasingly allocating portions of their portfolios to Bitcoin, driven by its perceived stability against inflation and geopolitical risks. Daniel Cunha of Mercado Bitcoin notes these businesses now represent 10-15% of the exchange's assets, mirroring corporate treasury strategies pioneered by firms like MicroStrategy.

The trend highlights Bitcoin's growing role as a reserve asset beyond speculative trading. While Brazil ranks fifth in global crypto adoption, only one public company currently discloses BTC holdings. This will change with OranjeBTC's upcoming B3 listing, which holds a $400 million Bitcoin treasury.

Bombay Stock Exchange Denies Jetking Infotrain Listing Over Bitcoin Investment Plan

The Bombay Stock Exchange rejected Jetking Infotrain's listing application after the IT training firm disclosed plans to allocate 60% of its ₹6 crore ($720,000) public raise into Bitcoin. This marks India's first known instance of an exchange blocking a listing due to cryptocurrency exposure.

India maintains a cautious stance on digital assets—while allowing crypto purchases with corporate profits, regulators prohibit public fundraising for such investments. Jetking Infotrain may appeal the decision to the Securities Appellate Tribunal, testing the boundaries of permissible treasury strategies.

The BSE's move reflects growing institutional scrutiny of crypto allocations, particularly when involving retail investor funds. Market participants will watch whether this establishes precedent for other exchanges navigating similar cases.

Bitcoin Faces Downward Pressure Amid Macroeconomic Headwinds

Bitcoin's recent decline highlights the cryptocurrency's sensitivity to broader market forces. A confluence of factors—including options expiry activity and shifting holder cost bases—has disrupted its typical performance patterns during a seasonally weak period.

The $17 billion options expiry at the $110,000 strike price created significant spot market turbulence. This technical pressure coincided with Bitcoin breaching the short-term holder cost basis of $110,775, a key psychological level that previously served as support during bull markets.

Market participants now face renewed questions about Bitcoin's resilience. While April's tariff-related selloff demonstrated its vulnerability to macroeconomic shocks, the longer-term trajectory remains contingent on institutional adoption and regulatory clarity.

U.S. Genius Act Opens Path for Bitcoin to Power Global Stablecoin Networks

The Genius Act, passed in July 2025, legalizes Treasury-backed stablecoins, marking a strategic shift as global demand for U.S. bonds weakens. This legislation aims to expand dollar access worldwide while leveraging Bitcoin's decentralized infrastructure for cross-border payments.

Tether and Circle, the dominant stablecoin issuers, now hold billions in U.S. Treasuries. Bitcoin's Lightning Network emerges as a critical solution—offering private, secure settlement layers for these dollar-pegged assets. The network's neutrality contrasts sharply with centralized alternatives.

Yields on 30-year Treasury bonds hit 4.75% in September 2025, reflecting dwindling foreign appetite. China's U.S. debt holdings have nearly halved since 2013, with analysts attributing this to geopolitical tensions following the freezing of Russian reserves in 2022.

Is BTC a good investment?

Based on current technical indicators and market developments, Bitcoin presents a compelling investment case with calculated risk. The technical analysis shows BTC trading near support levels with bullish MACD momentum, while fundamental factors include growing institutional adoption and regulatory advancements.

| Factor | Assessment | Impact |

|---|---|---|

| Technical Position | Near Bollinger Band support | Positive for entry |

| MACD Momentum | Bullish divergence | Short-term positive |

| Institutional Interest | Growing significantly | Long-term bullish |

| Regulatory Environment | Mixed but improving | Moderately positive |

| Macroeconomic Risks | Present but manageable | Requires monitoring |

As BTCC financial analyst Ava emphasizes, 'Investors should consider dollar-cost averaging and maintain a long-term perspective given Bitcoin's volatility and growth potential.'